A new report by Oxfam and the New Policy Institute says the coalition’s welfare cuts have pushed 1.75 million of the UK’s poorest households deeper into poverty, leaving more families struggling to cover food and energy bills.

A new report by Oxfam and the New Policy Institute says the coalition’s welfare cuts have pushed 1.75 million of the UK’s poorest households deeper into poverty, leaving more families struggling to cover food and energy bills.

The report highlights a drop in the overall value of benefits, which rose by less than inflation, as well as changes to housing benefit and council tax support that have forced some families into paying housing costs they were previously deemed too poor to pay.

The report found that 300,000 households have experienced a cut in housing benefit, 920,000 a reduction in council tax support and 480,000 a cut in both.

As a result of these cuts in housing benefit and changes to council tax support, around 1.75 million or the poorest families have seen an absolute cut in their income. Of these, 480,000 families are seeing their benefits being cut twice as they are affected by more than one of the changes. Whether a family is affected and by how much varies based on a range of factors which are largely out of the control of the individual. They depend on council tax band, the cost of local housing, family size and property size. But they all apply irrespective of income. The government needs to instate an ‘absolute minimum’ level of support. It should apply regardless of local authority or tenure and it should be high enough to prevent people from having to walk the breadline

Shelter warns that almost 4 million families are living without any safety net.

Shelter warns that almost 4 million families are living without any safety net. The FCA is concerned that customers are being charged high rates to contact financial services firms and will consult with industry, consumer organisations and consumers to ensure customer calls are more affordable.

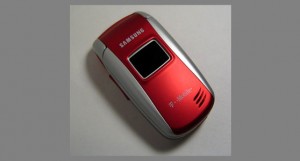

The FCA is concerned that customers are being charged high rates to contact financial services firms and will consult with industry, consumer organisations and consumers to ensure customer calls are more affordable. On 12th March Consumers International (CI) published its Consumer Agenda for Fair Mobile Services ahead of World Consumer Rights Day (WCRD) on Saturday 15 March.

On 12th March Consumers International (CI) published its Consumer Agenda for Fair Mobile Services ahead of World Consumer Rights Day (WCRD) on Saturday 15 March. The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014.

The Financial Conduct Authority has confirmed the final rules that will govern the £200bn a year consumer credit market, which includes approximately 50,000 firms, from 1 April 2014. Today DECC published the consultation document on the future of the Energy Company Obligation (ECO). The consultation will run from 5th March to the 16th April.

Today DECC published the consultation document on the future of the Energy Company Obligation (ECO). The consultation will run from 5th March to the 16th April. The review looked at how firms treat customers in arrears or financial difficulty. This is of particular concern as the possibility of interest rate rises looms. The review finds that arrears management in firms has improved since the last review. However, mortgage lenders and administrators need to place greater emphasis on delivering consistently fair outcomes for customers based on their individual circumstances.

The review looked at how firms treat customers in arrears or financial difficulty. This is of particular concern as the possibility of interest rate rises looms. The review finds that arrears management in firms has improved since the last review. However, mortgage lenders and administrators need to place greater emphasis on delivering consistently fair outcomes for customers based on their individual circumstances. Written evidence can be submitted until 13th March. Members might like to consider responding. See

Written evidence can be submitted until 13th March. Members might like to consider responding. See

This

This